Introducing Live, Automated Tax Rates for Native Stores

We’ve released a new automated tax feature for Duda’s native eCommerce, that lets you reduce cost, gain efficiency and minimize compliance risk when selling online. It’s a comprehensive solution integrated right into the Duda platform for easy, worry-free tax setup and management.

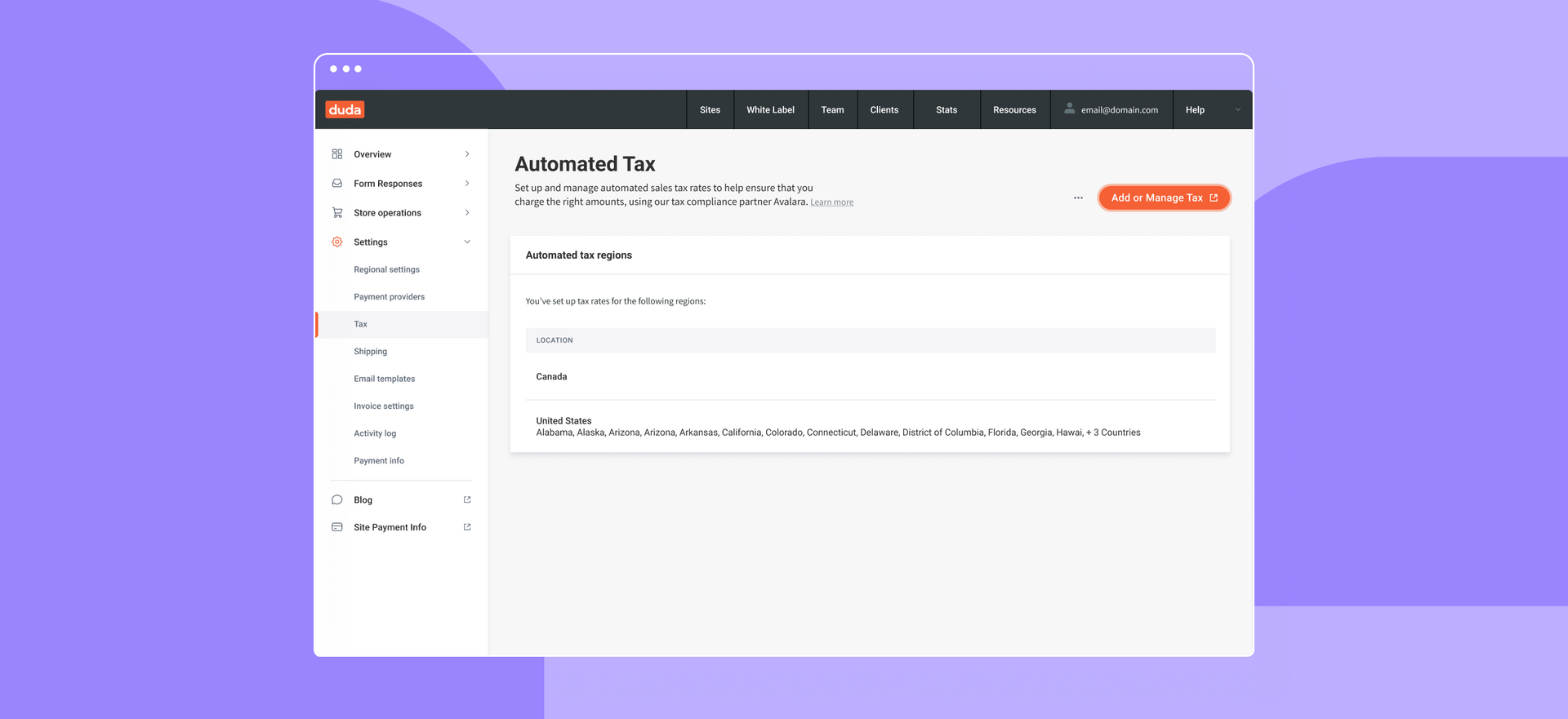

Powered by globally acclaimed tax compliance provider Avalara, the new automated taxes feature makes it easy to set up and manage auto-calculated tax rates in real-time for store purchases. In its first phase, this will be available for businesses and customers located in the US and Canada, with more supported locations coming soon.

Automated taxes are available with the Advanced Store site plan.

Save time and money. Gain accuracy and peace of mind

Let’s face it. Setting up sales taxes with full compliance can be a virtually impossible task if done manually, not to mention a costly operational overhead. There’s plenty of room for error, and you easily run the risk of charging too much or too little.

In addition, it can be challenging to navigate through the most updated tax rates or the different tax regulations in each US state or Canadian region. Duda’s new automated taxes capability takes care of that for you - it will auto-calculate and show the right tax rate at checkout, thus ensuring your clients’ sales taxation is fully compliant.

More importantly, automated taxes let your clients’ business scale rapidly and allow them to focus on what matters most - their business. And let’s not forget: you can up your revenue by offering eCommerce clients a robust feature they need with tangible value.

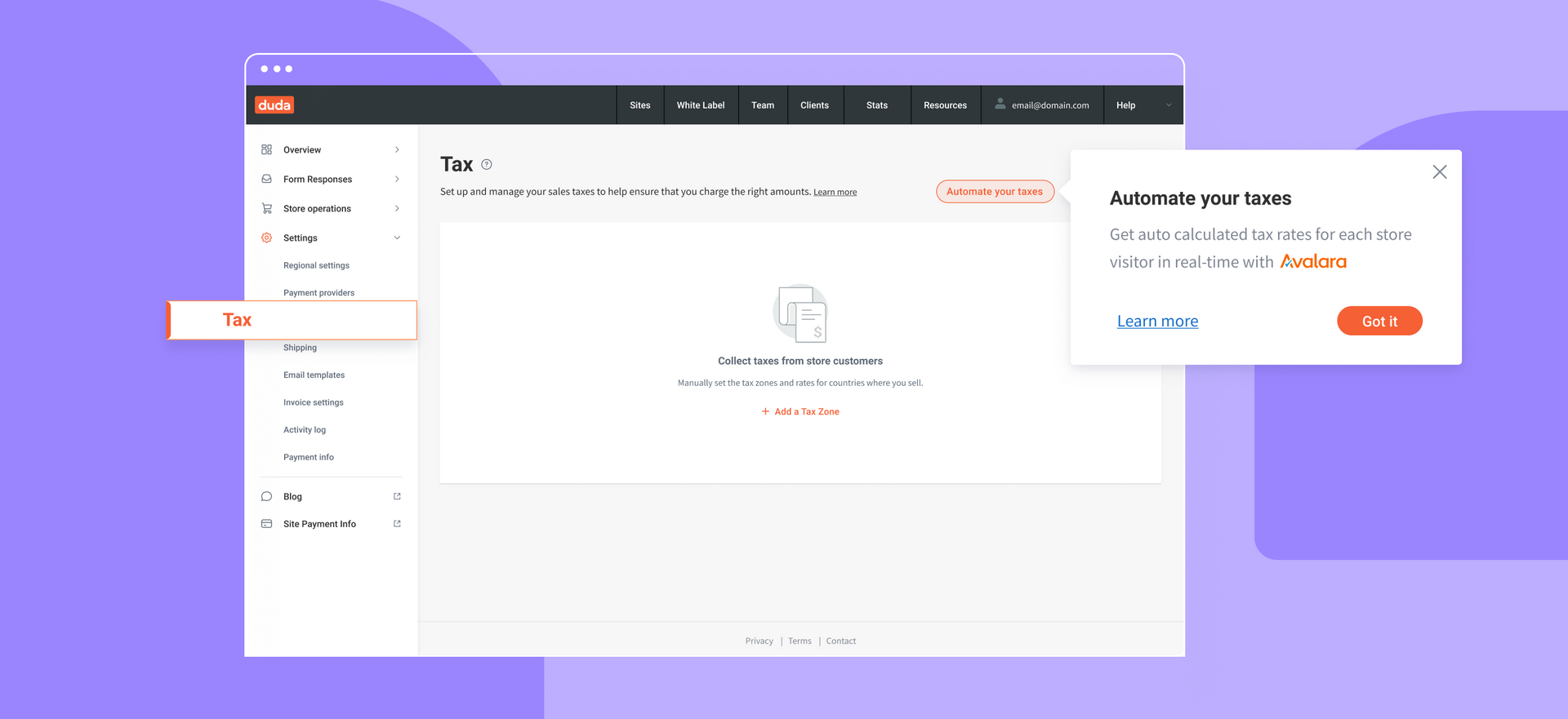

Integrate once, get live rates for every order

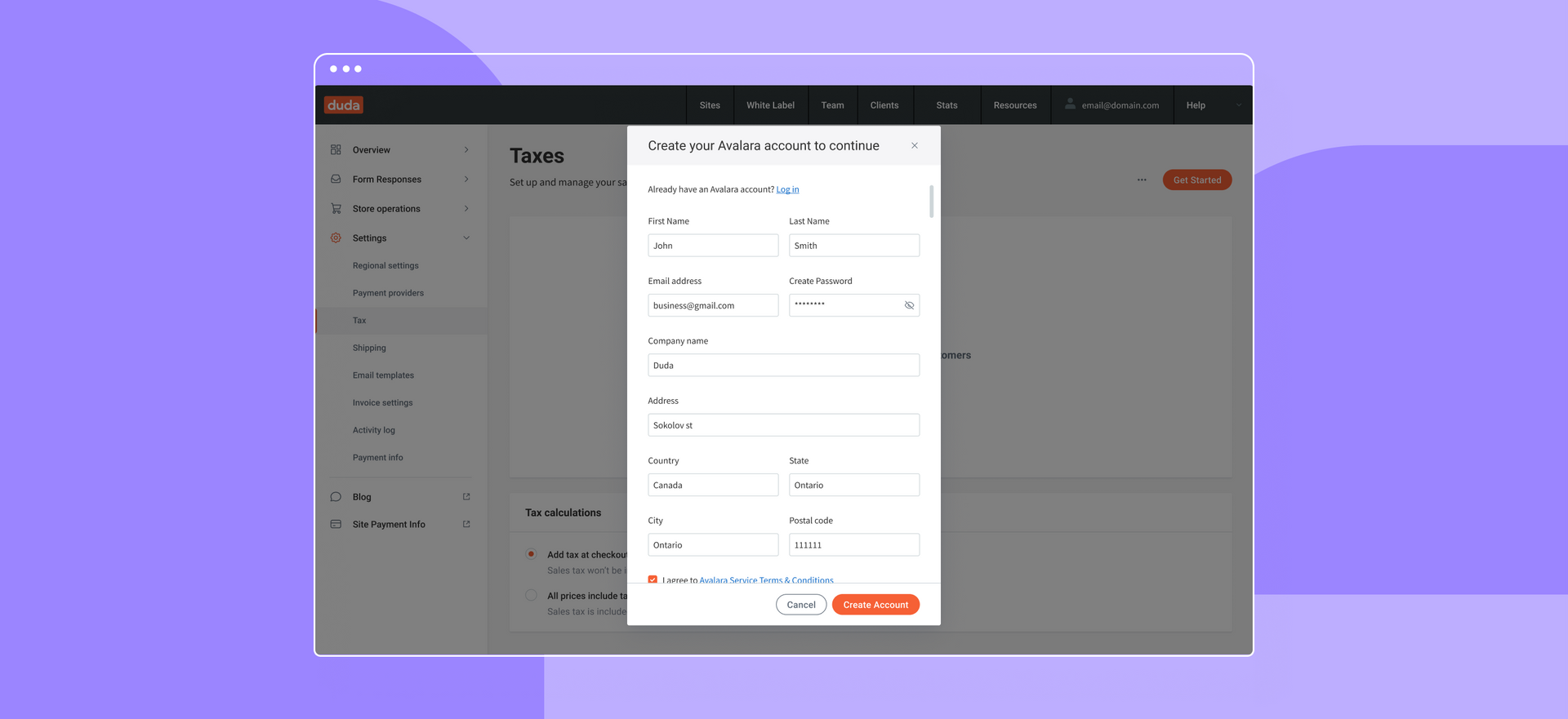

When starting out, we’ll ask you to create an Avalara account for your client if they don’t yet have one - it’s free to sign up (we’ll guide you through the process right within the platform). Once connected and enabled in your store’s US and Canada tax zones, automated taxes will take it from there. No need to set up anything else. Store customers will automatically see the accurate tax rate for their order at checkout.

Enjoy these core capabilities with automated taxes:

- Get live tax rates per order for every US or Canada customer at checkout (more supported countries coming soon)

- View your transaction history

- See per-transaction reporting in your Avalara account*

*Once creating an Avalara account, store orders will automatically show in your client’s Avalara dashboard. It’s up to them to decide if they want store order data to show in (or sync with) Avalara.

How to get started with automated taxes

First, make sure your native store has the Advanced plan (or upgrade if you have the Standard plan). Next, click the eCommerce tab from the left panel in the editor and select Set up taxes. Look for and hit the Get started button. From there, we’ll guide you through the Avalara signup process (or login if your client already has an account). That’s it!

For more information about automated taxes and how to set it up for your store, visit this support guide.